Optimal Path

Overview: Optimal Path offers a personalized, AI-driven solution that helps individual consumers to achieve their credit score goals.

Role: UX Researcher, UX/UI Designer

Toolkit: UserTesting, Optimal Workshop, Figma, Adobe CC, ChatGPT, and FullStory

UX Research

Overview

• Background

Optimal Path is designed to help financial institutions, employers, benefits providers, and other organizations provide consumers with personalized, actionable credit score plans within their existing consumer financial health initiatives and platforms:

- Personalized Goal Setting

- AI-Driven Task Recommendations

- Monthly Updates & Progress Tracking

*our hypothesis...

We believe that if consumers are given personalized, AI-driven monthly tasks, based on their current credit profile and data from similar consumers , then they will be more likely to take effective actions that improve their credit scores over time.

• Research Goals

if hypothesis is true

The business believes if we can increase user engagement and retention, support partner platforms with personalized credit tools, promote responsible credit behavior, we will unlock new monetization channels, showcase Equifax’s AI and data innovation, and drive adoption of the broader Equifax Cloud ecosystem..

• Methodologies

Quantitative: Surveys

Quantitative: Analytics and User Behavior Tracking

Quantitative: Competitive Analysis

Quantitative: A/B Testing

Qualitative: User Interviews

Qualitative: Diary Studies

Qualitative: Field Studies:

Qualitative: User Interviews

Competitive Analysis

Click to enlarge

User Interviews

• Overview

To understand user attitudes, behaviors, and needs around credit improvement, and evaluate the clarity, usefulness, and motivation provided by Optimal Path’s personalized credit-building recommendations. 15 Participants: individuals with varying credit scores (fair to good), actively interested in improving their credit within the next 6–12 months.

• Affinity Mapping:

Click to enlarge

Research Findings

High Interest in Personalized Guidance

Prefer specific tasks over generic tips

Score Impact Boost Motivation

Motivation and sense of control

Trust Hinges on Transparency

Credibility is critical

Overwhelm with Financial Jargon

Participants struggled with technical credit terms

Persona #1

Monica Miller

34y/o Customer Service Rep - 560 Credit Score

FREQUENTLY-USED APPS

Bio

Monica is a 34-year-old customer service representative and single mom living in a mid-sized city. After going through a financially difficult divorce, her credit took a major hit. She’s been steadily working to get back on her feet but feels overwhelmed by the complexity of credit improvement. Monica wants to qualify for a reliable car loan within the next six months so she can commute to a better-paying job.

She’s motivated but unsure where to start, and often feels anxious when using financial apps. Monica values guidance that’s straightforward, empathetic, and rooted in trust. She prefers clear, small steps she can realistically take each month—especially if she can see how they impact her score over time.

Goals

• Step-by-step guidance, reassurance, and clear explanations

• Tell me what to fix first—I just want to get on the right track.

• Clear explanations

• Wants financial independence and stability for her family

Frustrations

• Overwhelmed by where to start

• Distrusts financial systems

Persona #2

Jayden Weaver

23y/o - College Graduate, Entry-level IT - Credit Thin/no file

FREQUENTLY-USED APPS

Bio

Jayden is a 23-year-old recent college graduate starting his first full-time job in IT support. He has little to no credit history and is just beginning to understand how credit works. Jayden’s current goal is to build his credit score enough to rent an apartment on his own within the next year, but he finds most financial advice confusing and full of unfamiliar terms.

He’s digitally savvy and open to using tools that can guide him, as long as the experience feels clear and educational. Jayden is motivated to “do things right from the start” and wants a sense of progress without feeling judged or overwhelmed. He values transparency, simplicity, and gamified feedback that makes the credit-building journey feel achievable.

Goals

• Education, confidence, and encouragement without jargon

• Wants to build credit early to avoid mistakes later

• I didn’t even know credit utilization was a thing until last week.

Frustrations

• Lacks credit education

• Easily confused by terminology

UX Design

Prioritization

• Project Goals

Prioritize initiatives that drive key metrics like engagement, retention, and partner adoption

Find the right mix of low-effort/high-impact tasks and long-term innovations to maintain momentum and growth.

Factor in team capacity, platform dependencies, and API partner integration complexity.

Click to enlarge

• Features Roadmap

First on delivering personalized monthly credit improvement tasks, goal setting, and progress tracking with clear educational support. Mid-term plan include behavioral nudges, peer benchmarking, multi-goal management, and enhanced partner integrations. Long-term goals aim to add AI-driven scenario simulations, personalized credit product recommendations, gamification, advanced privacy controls, and seamless cross-platform syncing.

Click to enlarge

Information Architecture

I’ve built a sitemap to organize user data, personalized credit goals, AI-driven task recommendations, and progress tracking into an intuitive, layered structure. It connects core modules—Goal Setting, Monthly Tasks, Credit Score Updates, Educational Content, and User Profile—enabling seamless navigation and real-time personalization within the platform and partner integrations.

Click to enlarge

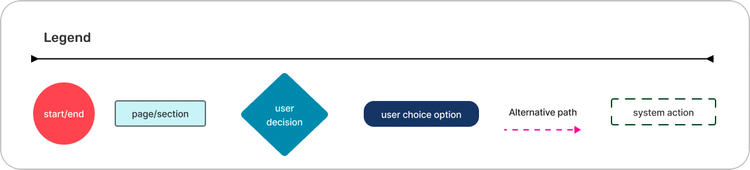

User Flows

I’ve immediately identified my two user flows:

• User Onboarding

• Goal Setting

• Monthly Task Review

• Task Completion Tracking

• Progress Monitoring

• Adjust Goals

• Educational Content Access

• Notifications & Reminders

• Privacy & Consent Management

• Partner Platform Integration

*Ideally, there is a third potential user flow I would have liked to explore: Credit data used by Optimal Path is sourced securely from Equifax’s credit databases, with user consent, and shared in compliance with privacy regulations (e.g., FCRA, GDPR where applicable).

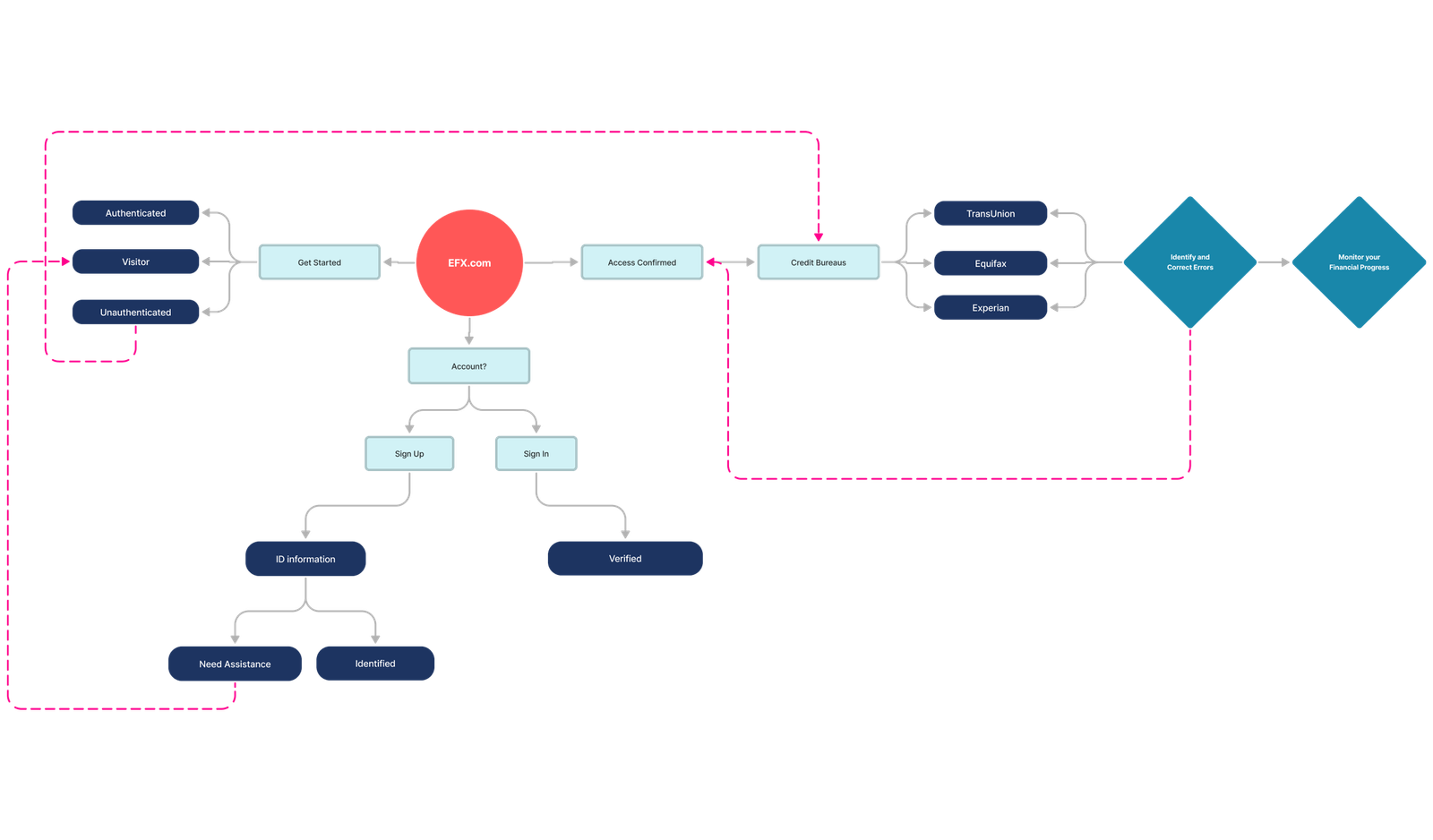

Task Flows

After designing user flows, it was quite straightforward to build up task flows. What I did was to expand in depth and explore users actions even further:

• Users update or change their credit score goals or timelines, triggering recalibration of recommended tasks.

#1 Use credit improvement actions based on their goals and credit profile

Click to enlarge

#2 The system track progress, updates the credit score accordingly

Click to enlarge

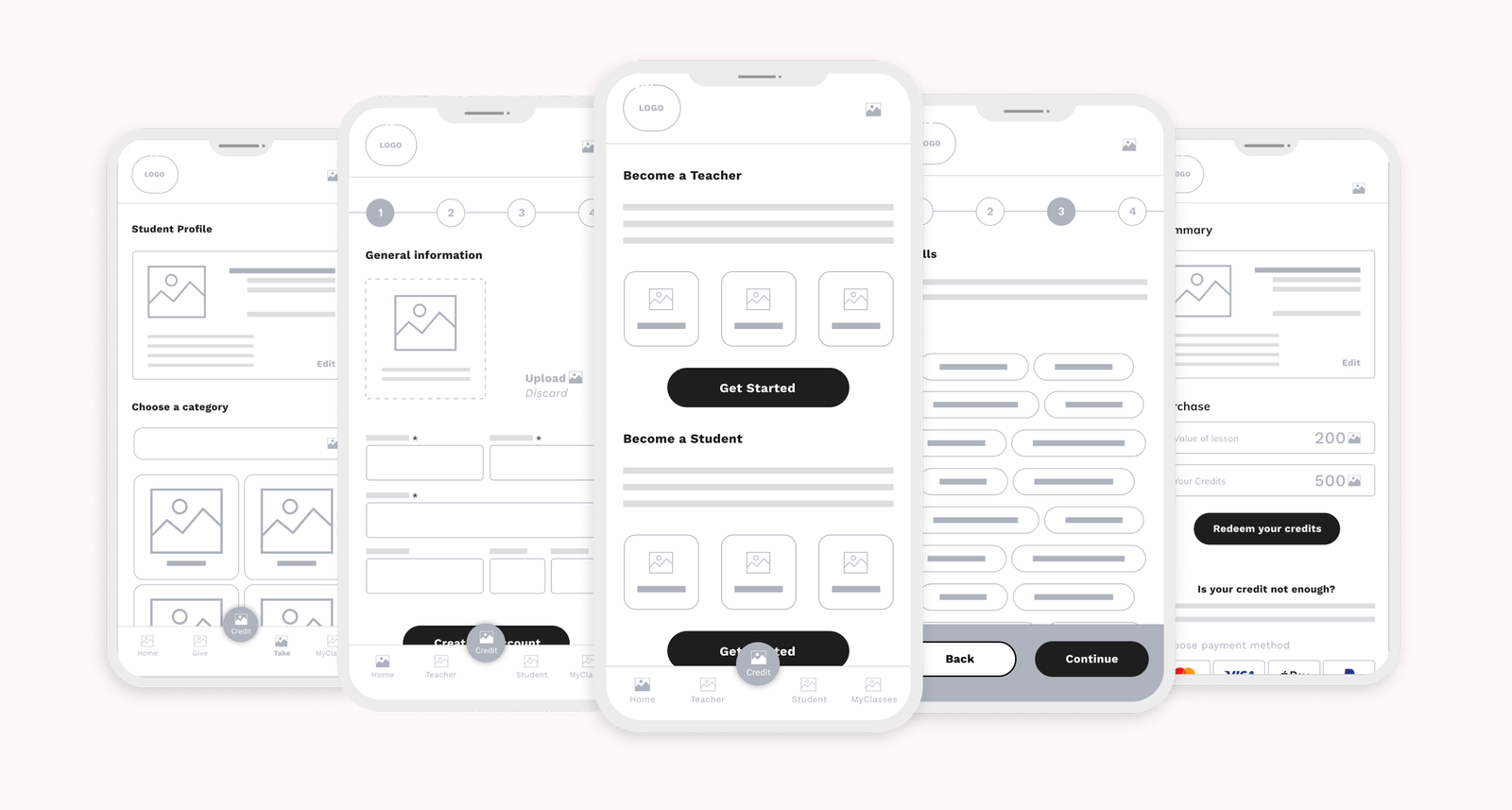

Wireframes

For the first flow, I’ve developed search inventory and vehicle display page, which I’ve divided in 4 main steps: Vehicle Information, Vehicle Assessment, Vehicle Inspection and additional information.

For my second flow, I’ve focused my attention on photos of damage callouts, announcements and history report and notes.

UI Design

Brand Identity

First of all, I’ve explored potential naming solutions and marks for my logo. Eventually, I’ve decided to go for the sphinx, symbol of great intelligence and wisdom in the ancient Egypt. The name Knowlex contains the words knowledge and exchange.

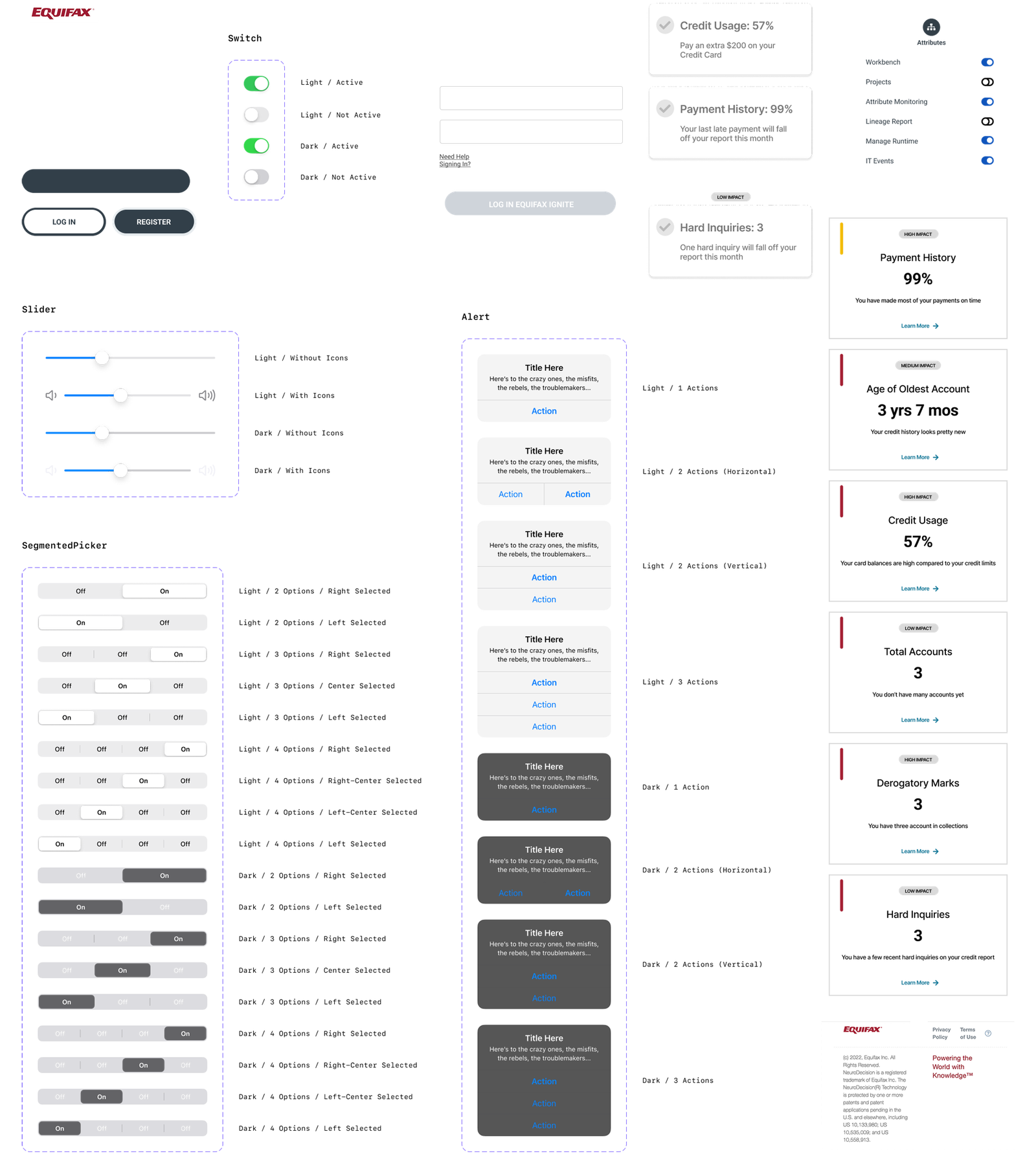

UI Library Components

I’ve created a colour palette with 1 primary, 2 secondary and 3 neutral colours. The choice for typography has fallen on Mulish, a sans-serif font with a decent x-height for legibility.

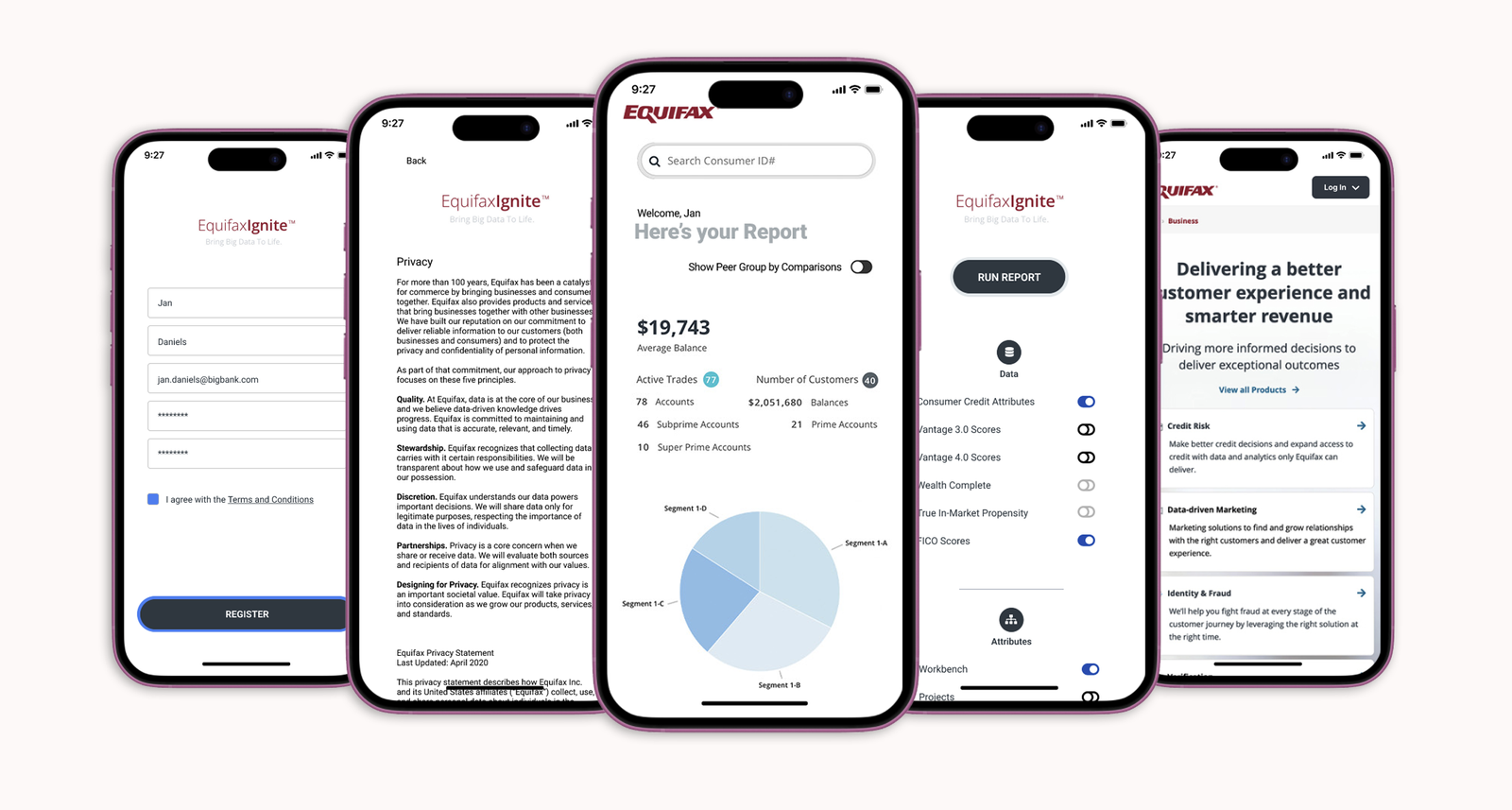

With those elements added to my low fidelity wireframes, I made my way into high-fidelity wireframes.

High-fidelity key-screens

Usability Test

Prototype

I’ve mainly worked with components and variants throughout the entire project. For that reason, it was quite straightforward to build up the prototype.

In order to keep the flow nice and neat, I’ve mainly used the same mild transition effect for every screen except for Intro and Get started transitions, where I went for a more bouncy effect to give the idea that something new is about to start.

Additionally, I’ve built a loading animation to make the prototype experience more realistic

Outcome

Overall, usability test was quite satisfying. The general flow and callouts of damages proved to be viable. I made a few changes that aimed at facilitating the flow even more.

Click to enlarge

Iterations

• To improve Create an account experience, I’ve added an activation message: a dedicated overlay with validation code to input

Click to enlarge

• To improve Application form flow, I’ve created a loading animation and a supplementary message that states the successful upload.

Click to enlarge

• To improve Checkout experience, I’ve differentiated info about Your credit and Value of lesson in terms of colours. I’ve also added Remaining Balance details

Click to enlarge

Test Project Prototype

Key Takeaways

• Challenge

- Credit scores are influenced by numerous factors (payment history, credit utilization, length of credit history, etc.)

- Balancing Personalized Advice and Actionability

- The AI engine behind Optimal Path analyzes complex data, but the challenge is to translate these insights into clear, actionable advice that consumers can easily understand and follow

- While Optimal Path aims for personalization, the challenge lies in providing recommendations that are not only tailored to the individual

• Lesson learned

- Generic advice is insufficient for engaging users in credit score improvement

- Users need clear, specific tasks to take, not just information. Providing estimated score impacts for these tasks motivates users and helps them prioritize their efforts